Introduction to Tally Accounting

Tally accounting is one of the most widely used financial management solutions for businesses of all sizes. Tally is a powerful accounting software that simplifies financial transactions, bookkeeping, and business reporting. It is particularly popular among small and medium-sized enterprises (SMEs) due to its user-friendly interface and robust functionality. The software has evolved over the years, providing advanced features such as GST compliance, inventory management, and payroll processing, making it an indispensable tool for businesses looking to streamline their financial operations.

Understanding the Basics of Tally Accounting

tally accounting revolves around maintaining financial records efficiently. The software enables businesses to track expenses, manage invoices, and generate reports with accuracy. One of the primary reasons why Tally has gained such widespread popularity is its ability to automate accounting processes, reducing manual errors and saving time. Unlike traditional bookkeeping methods, Tally allows businesses to record transactions digitally, ensuring data integrity and ease of access.

The software is based on the principles of double-entry accounting, meaning every transaction is recorded with a corresponding debit and credit entry. This helps maintain accuracy and transparency in financial records. Additionally, Tally offers multi-user access, which is beneficial for businesses that require multiple employees to handle accounting tasks simultaneously.

Features of Tally Accounting Software

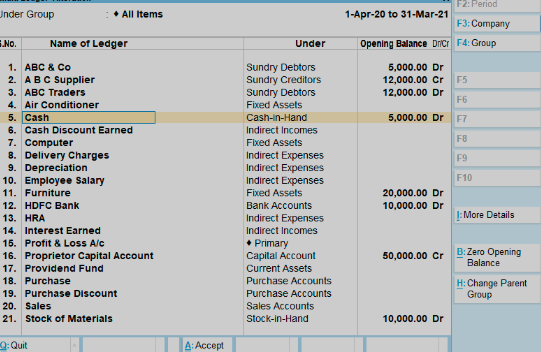

Tally accounting software is packed with features that cater to diverse business needs. One of its key features is ledger management, which enables users to create and manage different ledgers for accounts payable, receivable, expenses, and income. This simplifies financial tracking and ensures systematic record-keeping.

Another significant feature is inventory management, allowing businesses to monitor stock levels, track product movement, and generate inventory reports. This is particularly beneficial for retail and manufacturing businesses that need to keep a close eye on their stock levels to prevent overstocking or understocking.

Tally is also well-known for its GST compliance capabilities. The software helps businesses calculate and file GST returns seamlessly, ensuring adherence to tax regulations. Additionally, it supports payroll processing, enabling businesses to manage employee salaries, deductions, and benefits efficiently.

Advantages of Using Tally for Accounting

One of the biggest advantages of Tally accounting is its simplicity and ease of use. Unlike other complex accounting software, Tally provides an intuitive interface that even individuals with limited accounting knowledge can navigate effortlessly. It offers quick access to essential financial reports, helping business owners make informed decisions.

Another advantage is automation. Tally automates repetitive accounting tasks such as bank reconciliation, invoice generation, and tax calculations. This reduces the risk of errors and enhances efficiency in financial management.

Tally also provides data security and backup options, ensuring that financial information is safe from unauthorized access and data loss. The software allows businesses to take regular backups and restore data when needed, preventing any disruption in financial operations.

How Tally Accounting Helps Businesses Stay Compliant

Compliance with financial and tax regulations is a crucial aspect of running a business. Tally accounting software ensures businesses adhere to regulatory requirements by providing built-in tax management features. The software supports GST, VAT, TDS, and other tax calculations, making it easier for businesses to file accurate tax returns.

Moreover, Tally simplifies audit processes by generating detailed financial reports and maintaining accurate records. Auditors can easily access transaction history, balance sheets, and profit and loss statements, ensuring transparency in financial management. This is particularly beneficial for businesses that undergo regular financial audits or need to present their financial statements to stakeholders.

Tally Accounting for Small and Medium-Sized Enterprises (SMEs)

Small and medium-sized enterprises (SMEs) often struggle with managing their finances due to limited resources. Tally accounting software serves as a cost-effective solution for SMEs by offering essential accounting features without the need for extensive financial expertise. The software enables SMEs to keep track of income, expenses, and tax obligations efficiently, reducing the burden of financial management.

Additionally, Tally helps SMEs optimize cash flow by providing real-time insights into financial performance. Business owners can monitor outstanding payments, manage supplier transactions, and plan budgets effectively. This ensures financial stability and growth for small businesses.

The Future of Tally Accounting

With advancements in technology, Tally continues to evolve and adapt to changing business needs. The integration of cloud-based accounting solutions is one of the most significant developments in recent years. Cloud-based Tally solutions enable businesses to access their financial data from anywhere, enhancing flexibility and convenience.

Another emerging trend is the incorporation of artificial intelligence (AI) and automation in Tally accounting. AI-powered analytics help businesses gain deeper insights into financial data, identify trends, and make data-driven decisions. Additionally, automation features will continue to enhance efficiency by reducing manual accounting tasks and improving accuracy.

Conclusion

Tally accounting has transformed the way businesses manage their finances. From ledger management and inventory tracking to tax compliance and payroll processing, the software offers comprehensive features that simplify financial operations. Its user-friendly interface, automation capabilities, and cost-effectiveness make it an ideal choice for businesses of all sizes, particularly SMEs.

As businesses continue to embrace digital transformation, tally accounting software is expected to evolve further, integrating more advanced features to meet the growing demands of financial management. Whether you are a small business owner or a large enterprise, adopting Tally accounting can significantly improve efficiency, accuracy, and compliance in financial operations.

Leave a Reply