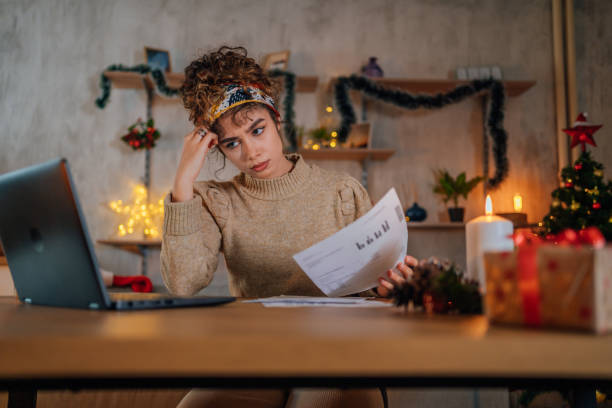

The holiday season is officially over, and it is time to recall the expenses. A well-managed financial system will give you the power to cover maximum payouts. Even though some are left out, you will have a process in place to recover from them easily.

In the other case, when you do not follow a systematic approach or do not have a plan, the financial burden is going to be huge. You will have to think of ways to trim down the cost with time. There are a few things to shuffle, including financial habits, to get back on track.

It is true that holidays will leave you unprepared for a few payouts. No matter how you plan for this, some outgoings will pop up out of the blue. Since you have to face some issues without any preparation, some payments might remain unpaid.

With zero financial planning, you will have to accept a huge pile of debts. On the flip side, with some preparation, you can be in a position to bring your finances within control. This blog will take you through the different steps you should take to overcome holiday overspending.

Bid adieu to financial challenges after the holidays are over

No one wants to end the holiday season with a heavy heart and an empty pocket. The financial strain can make you feel more pain. Now, imagine how you might feel when you have fewer pending issues to deal with.

You will obviously be more relieved and productive towards your goals. There is no need for you to regret and do nothing to recover from the financial trap you have entered. With a few effective steps, you can again stabilise your financial situation.

· Conduct a financial audit

This is about analysing the situation you are in. You will then realise how much you have spent. At the same time, you will get a reality check on the amount you are supposed to spend.

If the difference is enormous, this is a serious problem. For this, you might even have to switch to a frugal lifestyle as well. On the other hand, you have the least to worry about if the difference seems manageable.

This audit will let you take a tour of your savings that you can use after perceiving the intensity of the problem. A complete breakdown of where the money went and from where you should arrange cash is the ultimate motive for this step.

· Think of utilising a loan to manage debts

Pending payments will rack up and attract more charges. This way, you might invite new debts, and you will have to handle them at the same time. It is difficult to manage different payments with different rates of interest together.

Individually, you have to gather amounts and make up for the amount. Failing to do so will worsen your credit scores. However, you can look for a one-stop solution to this problem.

This could be debt consolidation loans for bad credit in the UK. These loans are obtainable even when your credit history is imperfect. Besides, you can treat all the debt payments together.

This means that these loans let you club all the pending payments together. Then, you will be accountable for taking care of a single rate of interest. This is because you will be paying off the outstanding amount from different debts through a loan.

The best thing is that you can tackle multiple debts with a single financing option. Moreover, you will not be burdened with a strict repayment term. You will have the opportunity to clear up loan payments over the next few months.

· Redo the budget arrangement

Now, you might have taken out a loan, which will require you to focus on repayment. This indicates that you must draw out additional cash from the budget to complete the loan payments. If you do not go ahead with this step, loan payments will suffer because of this.

Some payouts which can be adjusted should be paused for the time being. This will let you free up some cash that can be utilised for loan payments.

· Add up earnings if you need extra money

Maybe you need surplus funds to be ready in your wallet to go ahead with some payments. At this stage, you cannot ask for a sudden hike in salary. The only safe option for you to use would be to try outside jobs.

They give you the flexibility to work at any time. You do not have to adjust your office hours. You just have to effectively use your time to gather additional funds by working on some part-time projects.

This is a good idea as you do not have to accumulate debts to manage the existing outstanding. Besides, you do not have to let go of some payouts. On top of this, you can use your own money that does not rack up interest rates.

· Take advice from an expert

Now, you might feel clueless about how to approach the ongoing crisis. You might need a safe way that can ensure the least trouble and maximum relief. An expert can guide you on how to go about the problem.

They specialise in that and have relevant experience as well. You should be ready to meet their fees as it is their job. However, they guarantee 100% guidance that can help you get out of trouble.

The bottom line

Life can be stressful to manage at times. Similarly, you can have multiple problems at the same time. You can have tonnes of pending payments to handle with no job at all.

In this situation as well, you can get financial assistance like loans for benefits from a direct lender. Using these loans, you can make up for the additional payments that went pending. Meanwhile, you must try to start a side gig so that you can strike a balance between expenses and income.

Thus, a unique strategy should be implemented, given the circumstances you are facing. Maybe you need a small amount, and this can easily be fetched by adjusting the budget. Here, you can manage the tricky situation without considering borrowing external funds.

Leave a Reply