In small business operations, efficiency and accuracy are vital. Payroll management stands out as a critical area where these qualities are indispensable. QuickBooks Payroll Checks, a feature within QuickBooks’ extensive suite of accounting tools, are fundamentally changing how small businesses handle their payroll processes. This article delves into the various ways QuickBooks checks are transforming small businesses, making payroll management more efficient, accurate, and hassle-free.

The Evolution of Payroll Management

Traditionally, payroll management was a cumbersome and time-consuming process. It involved manually calculating employee hours, deductions, taxes, and issuing physical checks. Any errors in these calculations could lead to employee dissatisfaction and potential legal issues. With the advent of digital solutions, payroll management has seen a significant transformation, and QuickBooks payroll checks are at the forefront of this change.

What Are QuickBooks Payroll Checks?

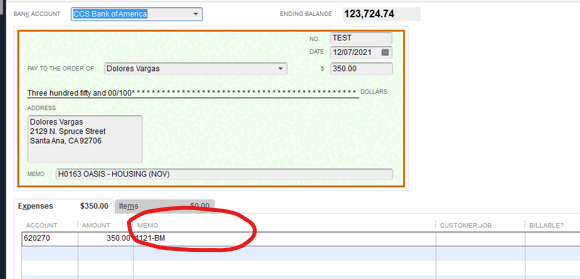

QuickBooks payroll checks are part of Intuit’s QuickBooks software, a comprehensive accounting solution designed to help small businesses manage their finances. Payroll checks automate the process of calculating payroll, including taxes and deductions, and allow for direct deposit or the printing of checks. This automation reduces errors and saves valuable time for small business owners and their staff.

Key Features of QuickBooks Checks

QuickBooks Checks come with a range of features designed to simplify payroll processing and enhance business operations.

- Automated Payroll Calculations: One of the standout features of QuickBooks checks is its ability to automate payroll calculations. This involves calculating gross compensation, deductions, taxes, and net pay. Automation reduces the risk of errors, saves time, and ensures employees are paid accurately and on time.

- Direct Deposit and Check Printing: Payroll checks offer flexibility in payment methods. Employers can choose to pay their employees via direct deposit or print physical checks. This flexibility caters to the diverse preferences of employees and enhances convenience for business owners.

- Tax Filing and Compliance: Keeping up with tax requirements is critical for every business. QuickBooks payroll checks assist in calculating and withholding federal, state, and local taxes. Additionally, it generates necessary tax forms and ensures timely filing, reducing the risk of penalties.

- Employee Self-Service Portal: QuickBooks provides an employee self-service portal where employees can access their pay stubs, W-2 forms, and other payroll-related information. This feature empowers employees and reduces administrative tasks for business owners.

- Integration with QuickBooks Accounting: Seamless integration with QuickBooks accounting software is a significant advantage. Payroll data syncs automatically with accounting records, providing a comprehensive view of the business’s financial health and simplifying bookkeeping.

Getting Started with QuickBooks Payroll Checks

For small business owners looking to implement QuickBooks checks in payroll management, the process is straightforward.

1. Choose the Right Plan

QuickBooks offers several payroll plans to suit different business needs. It’s important to choose the plan that best fits your business size and payroll complexity. Options range from basic payroll processing to full-service plans that include tax filing and employee self-service features.

2. Set Up Your Payroll

Setting up QuickBooks payroll checks involves entering employee information, including pay rates, tax withholdings, and deductions. The setup process is user-friendly, with step-by-step guidance provided by QuickBooks.

3. Automate and Customize

Once set up, you can automate payroll processing according to your pay schedule. QuickBooks also allows for customization to meet specific business needs, such as different pay rates, overtime calculations, and specific deductions.

4. Regularly Update and Review

To ensure continued accuracy and compliance, it’s important to regularly update employee information and review payroll reports. QuickBooks makes this easy with intuitive dashboards and reporting tools.

Future Trends in Payroll Management

With fast-evolving technology, the following developments can be seen in payroll management:

1. Increased Automation and AI Integration

The future of payroll management lies in increased automation and artificial intelligence (AI) integration. QuickBooks is likely to continue enhancing its automation capabilities, further reducing manual intervention and increasing efficiency.

2. Mobile Payroll Management

As mobile technology advances, small business owners will have more options to manage payroll on the go. Mobile payroll management will offer greater flexibility and convenience, allowing businesses to process payroll from anywhere.

3. Advanced Analytics and Reporting

Data-driven decision-making is becoming increasingly important. Future iterations of QuickBooks payroll checks may include advanced analytics and reporting features, providing businesses with deeper insights into their payroll data and helping them make informed decisions.

4. Enhanced Employee Engagement Tools

Employee engagement is a crucial factor in business success. Future developments in payroll software may include enhanced tools for employee engagement, such as personalized financial wellness programs and more interactive self-service portals.

Frequently Asked Questions

Q. How do QuickBooks checks improve payroll accuracy?

- QuickBooks payroll checks automate payroll calculations, including gross pay, deductions, taxes, and net pay. This automation reduces the risk of manual errors and ensures employees are paid accurately and on time.

Q. Can QuickBooks checks handle tax compliance?

- Yes, QuickBooks checks assist with tax compliance by calculating and withholding federal, state, and local taxes. The software also generates necessary tax forms and ensures timely filing, reducing the risk of penalties.

Q. How do employees benefit from QuickBooks checks?

- Employees benefit from QuickBooks payroll checks through timely and accurate payments, access to an employee self-service portal where they can view pay stubs and W-2 forms, and the flexibility of receiving payments via direct deposit or printed checks.

Q. What are the costs associated with QuickBooks checks?

- QuickBooks offers several payroll plans with varying features and costs. Business owners can choose a plan that best fits their business size and payroll complexity, ranging from basic payroll processing to full-service plans that include tax filing and employee self-service features.

Conclusion

QuickBooks payroll checks are indeed revolutionizing small businesses by transforming the way payroll is managed. The automation of payroll calculations, tax compliance, and payment processing saves time, reduces errors, and improves employee satisfaction. The integration with QuickBooks accounting software ensures that financial records are always up-to-date and accurate. For small businesses looking to streamline their payroll processes, improve accuracy, and focus more on growth and less on administrative tasks, QuickBooks checks provide a powerful and cost-effective solution.

Leave a Reply