Independent paralegals play a crucial role in the legal field, assisting attorneys with research, drafting documents, and managing client communications. As self-employed professionals, they are responsible not only for providing valuable legal support but also for managing their finances. One of the most important tasks for independent paralegals is keeping track of their income and expenses, which can often be complex and time-consuming. To simplify this process, a free paycheck creator can be an invaluable tool.

In this blog, we’ll explore how independent paralegals can benefit from using a free paycheck creator to keep track of their income, maintain accurate financial records, and ensure they stay organized throughout the year. We’ll break down the advantages, explain how it works, and offer tips on making the most of this tool to streamline payroll management.

The Challenges Independent Paralegals Face in Tracking Income

Independent paralegals are typically paid on a contract basis or hourly rate, which means that tracking income can become complicated. They might work with several clients, each with different payment structures, billing rates, and deadlines. Additionally, some clients may pay regularly, while others might take longer to pay, making it difficult to monitor cash flow. Here are some common challenges independent paralegals face when it comes to income tracking:

- Inconsistent Payments: Some clients may pay on time, while others may delay payments, creating uncertainty about how much income has been received and how much is still owed.

- Multiple Clients: Independent paralegals often juggle several clients at once, each with varying billing rates and contract terms. Keeping track of payments for each client can be overwhelming.

- Tax Deductions and Self-Employment Tax: As self-employed professionals, paralegals are responsible for calculating and paying their own taxes. This includes self-employment taxes, federal income taxes, and potentially state taxes. Keeping track of deductions like business expenses and mileage can also add to the complexity.

- Billing and Invoicing: Independent paralegals must issue invoices to clients for their services. Each invoice needs to be accurate and detailed to avoid payment disputes, but manually tracking this can lead to mistakes.

- Time Tracking: For hourly work, paralegals must accurately track the hours spent on each client’s case. This is important not only for billing but for maintaining financial records.

The good news is that a free paycheck creator can help address these challenges by automating many of these tasks and offering a more efficient way to keep track of income and payments.

What is a Free Paycheck Creator?

A free paycheck creator is an online tool that helps self-employed individuals, such as independent paralegals, generate professional paychecks and pay stubs. These tools automate the process of calculating income, deductions, and taxes, saving time and reducing the risk of errors. By using a paycheck creator, paralegals can easily track the income they’ve earned, as well as any deductions and taxes that need to be paid.

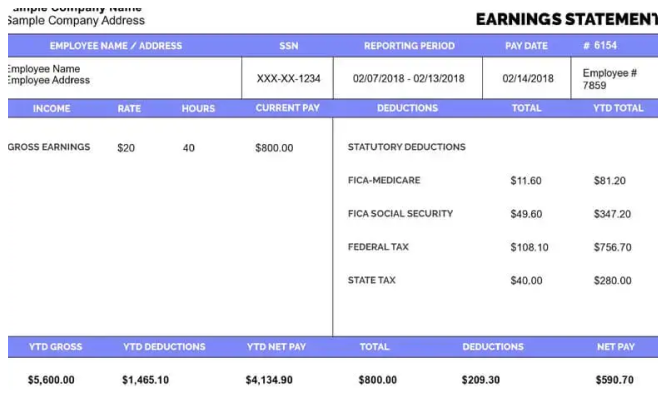

A free paycheck creator typically allows users to input their hourly rates, the number of hours worked, any additional income sources, and any deductions (e.g., taxes, business expenses, etc.). The tool then generates a paycheck with a breakdown of gross income, deductions, and net income. Many free paycheck creators also offer customizable templates, allowing users to include their branding or personal information on the pay stub, providing a more professional look.

Benefits of Using a Free Paycheck Creator for Independent Paralegals

Independent paralegals can enjoy a number of benefits by using a free paycheck creator to track their income and simplify their payroll processes. Let’s take a look at the top advantages:

1. Accurate Income Tracking

One of the main advantages of using a free paycheck creator is the ability to track income accurately. As an independent paralegal, you may work with several clients, each with different payment schedules. A paycheck creator helps consolidate all your earnings by generating pay stubs that reflect the correct amount for each project or client.

Instead of manually calculating your income from multiple invoices or trying to track hours worked, the paycheck creator automates these tasks for you. This reduces the risk of errors, ensuring that your income records are always accurate and up-to-date.

2. Simplified Tax Calculations

As a self-employed individual, you’re responsible for your own taxes. This includes federal income taxes, self-employment taxes, and potentially state income taxes. A free paycheck creator can help simplify this process by automatically calculating deductions for taxes based on the information you input, such as your income and filing status.

In addition to tax deductions, a paycheck creator can also help track other business expenses that may be deductible. This includes costs such as office supplies, legal research materials, or transportation expenses. By using a paycheck creator, you can easily keep track of these expenses for tax purposes, making it easier to file your tax return at the end of the year.

3. Easy Invoicing and Billing

Billing clients accurately and promptly is a critical part of being an independent paralegal. With a paycheck creator, generating invoices becomes easier and more efficient. You can input the hours worked, billable rate, and any additional fees, and the tool will generate a professional invoice that you can send to your client.

By having a clear and professional invoice, you help reduce the risk of disputes with clients regarding billing. You’ll also have a record of the services you provided, which can be useful if any questions about the invoice arise.

4. Time Tracking and Billing

Many independent paralegals charge by the hour for their services. For accurate billing, it’s crucial to keep track of how many hours you’ve worked for each client. A paycheck creator can integrate time tracking features, allowing you to record and track your hours seamlessly.

Instead of manually calculating the total hours worked or relying on external time tracking software, a paycheck creator helps you stay organized by automatically including your hours worked in the generated paychecks. This makes the billing process faster and more accurate.

5. Professionalism and Branding

When you use a paycheck creator, the pay stubs and invoices generated are professional-looking and easy to understand. You can customize the templates with your business name, logo, and other branding elements, helping you present yourself as a professional and reliable service provider.

Having professional invoices and pay stubs is important not only for maintaining a good relationship with your clients but also for your own records. It makes it easier for clients to understand your payment terms, and it provides you with a clear and organized way to track your income.

6. Record-Keeping and Financial Organization

As a self-employed paralegal, it’s essential to keep track of your financial records for tax purposes, auditing, and personal reference. A paycheck creator automatically stores all generated pay stubs and invoices digitally. This makes it easier for you to organize your records and access them whenever necessary.

Having a digital record-keeping system also reduces the risk of losing important documents and helps you stay organized. You can easily search through your pay stubs and invoices if you need to refer to them in the future.

How to Use a Free Paycheck Creator

Using a free paycheck creator is simple. Here’s a step-by-step guide on how to use it:

- Choose a Tool: Select a free paycheck creator that fits your needs. Look for one that offers customizable templates and time-tracking features.

- Enter Your Information: Input the relevant details for each client, such as hourly rate, total hours worked, and any additional fees or deductions.

- Generate the Paycheck: Once you’ve entered the necessary information, the tool will automatically generate a pay stub that includes your gross income, deductions, and net pay.

- Invoice Clients: After generating the pay stubs, you can use the tool to create professional invoices to send to your clients for payment.

- Store and Organize: Keep digital copies of your pay stubs and invoices in an organized manner for easy access later.

Conclusion

For independent paralegals, managing income, taxes, and client billing can be a complex task. Using a free paycheck creator simplifies the entire process, helping you track your earnings accurately, manage invoices, and stay on top of taxes. By automating many of the tasks involved in payroll management, a paycheck creator reduces the risk of errors, saves time, and helps you stay organized.

Whether you’re just starting as an independent paralegal or looking for a way to streamline your current workflow, a free paycheck creator is an essential tool that can help you stay on top of your finances, present yourself as a professional, and ultimately focus more on the work you love—supporting your clients in the legal field.

Related Articles

Access Your Pay Information Using eStub in 2025

TruBridge Paystub Not Showing? Here’s What to Do

Why Employer Should Use a Free Payroll Check Stubs Template?

Leave a Reply