Managing payroll is one of the most important tasks for any business owner. Whether you’re a startup entrepreneur, a freelancer, or managing a small business, paying your employees accurately and on time is essential. One of the most crucial parts of this process is generating pay stubs.

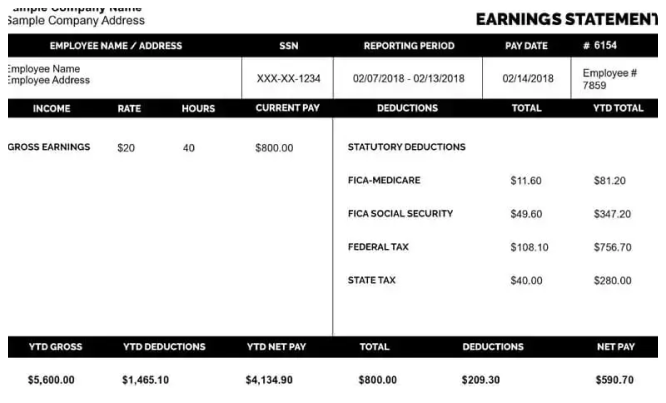

A pay stub, also known as a paycheck stub, is a document that provides detailed information about an employee’s earnings and deductions. It helps employees keep track of their income, taxes, and other withholdings, while also acting as an official record for tax purposes.

For many small business owners or freelancers, the idea of investing in expensive payroll software may not seem practical, especially when you’re just getting started. Fortunately, there are free paystub generators that can help you create real check stubs without breaking the bank. In this ultimate guide, we’ll walk you through everything you need to know to choose the right free paystub generator for your business.

What is a Paystub Generator?

A paystub generator is an online tool that allows you to create pay stubs quickly and easily. You can enter essential information about an employee’s pay, including their gross income, deductions, tax withholdings, and net pay, and the generator will automatically create a formatted pay stub. Most paystub generators are simple to use, even for individuals with no payroll experience, and many of them are free.

When choosing a free paystub generator, it’s important to ensure that it can create real check stubs—pay stubs that meet legal standards and include all necessary details such as income, taxes, and deductions.

Why Should You Use a Free Paystub Generator?

If you’re a startup, a small business owner, or a freelancer managing a few employees or contractors, you might wonder why you should use a free paystub generator. Here are some key reasons why it’s a great choice:

1. Cost-Effective

The most obvious benefit is cost savings. Free paystub generators allow you to create pay stubs without having to invest in expensive payroll software. This is especially important for new business owners who need to keep costs low in the early stages of their business.

2. Easy to Use

Most free paystub generators are designed to be user-friendly, so even if you don’t have payroll experience, you can still create accurate pay stubs in just a few minutes. The process typically involves filling out a few fields such as employee name, salary, deductions, and hours worked.

3. Accuracy

Using an automated paystub generator ensures that all calculations are done correctly, reducing the risk of human error. These tools calculate things like federal and state taxes, Social Security, Medicare, and other deductions automatically, so you don’t have to worry about getting the numbers wrong.

4. Time-Saving

Creating pay stubs manually can take a lot of time, especially if you have multiple employees. A free paystub generator allows you to quickly input data and create pay stubs, saving you valuable time so you can focus on other aspects of your business.

5. Professional Look

A good free paystub generator will help you create pay stubs that look professional. This is important not only for keeping your records organized but also for providing your employees with clear, understandable pay stubs that they can use for things like applying for loans or filing taxes.

Key Features to Look for in a Free Paystub Generator

When choosing the right free paystub generator for your business, there are several important features you should look for to ensure that the tool meets your needs.

1. Customization Options

A good paystub generator should offer customization options. This allows you to add your business name, logo, and other details to make the pay stub look professional and unique to your business. Customization also allows you to include all the relevant information, such as overtime pay, bonuses, and commissions, as needed.

2. Tax Calculations

One of the most important functions of a paystub generator is its ability to automatically calculate taxes and deductions. This includes federal income tax, state taxes, Social Security, Medicare, and any other withholdings that apply in your state or locality. The generator should be able to handle multiple tax jurisdictions to ensure compliance.

3. Support for Different Payment Structures

Not all employees are paid the same way. Some are hourly workers, while others are salaried or paid on commission. A good free paystub generator should support a variety of payment structures, including:

- Hourly pay

- Salary pay

- Overtime calculations

- Bonuses and commissions

Make sure the generator allows you to input various pay structures so that you can generate accurate pay stubs for all types of employees.

4. Simple, User-Friendly Interface

If you’re a small business owner or entrepreneur, you probably don’t have the time to learn complex software. Choose a paystub generator with an intuitive, easy-to-use interface. You should be able to create pay stubs quickly without having to go through complicated steps. Ideally, the process should involve filling in a few basic details and clicking “Generate” to create the pay stub.

5. Accuracy and Compliance

Ensure the free paystub generator you choose provides accurate and legally compliant pay stubs. This includes using up-to-date tax rates and including all the necessary information required by law. The pay stub should list:

- The employee’s gross earnings (total before deductions)

- Deductions for taxes, benefits, and other withholdings

- The employee’s net pay (the amount they take home)

- Pay period details (e.g., weekly, bi-weekly, monthly)

Check that the generator produces pay stubs that meet the requirements of your state and federal laws.

6. Download and Print Options

Once you’ve created a pay stub, you’ll want to download it in a format that is easy to save and share. PDF is the most common format for pay stubs, as it is both secure and professional. Ensure that the generator offers an option to download and print the pay stub so you can keep records for your business and provide them to employees.

7. Security and Privacy

When dealing with sensitive employee information, security is crucial. A good paystub generator should ensure that all your data is stored securely and that access is restricted. Look for tools that use encryption to protect employee data, especially if you are storing or sharing pay stubs online.

8. No Hidden Fees

Make sure the paystub generator is truly free. Some tools may offer a free trial or basic version, but then charge fees for additional features or to generate more pay stubs. Look for a paystub generator that provides a free plan with no hidden fees, so you can use it as long as you need without worrying about surprise charges.

9. Customer Support

Even though free tools are cost-effective, you must have access to customer support in case you run into issues. Whether it’s a technical problem or a question about using the tool, reliable customer support can be a lifesaver.

Top Free Paystub Generators for Startups and Entrepreneurs

Here are some of the best free paystub generators available that offer the features we’ve mentioned:

1. PayStubCreator

PayStubCreator is a highly rated free paystub generator that’s perfect for small businesses and entrepreneurs. It allows you to create real check stubs quickly and easily. The free plan offers limited pay stubs, but it includes all the necessary features like tax calculations, customizable templates, and downloadable PDFs.

2. CheckStubMaker

CheckStubMaker offers a simple interface that allows you to create pay stubs in just a few minutes. You can generate pay stubs for free with basic features, but they also offer paid options for additional functionalities like more pay stubs or advanced customization.

3. 123PayStubs

123PayStubs is another user-friendly paystub generator with a free plan that lets you create a limited number of pay stubs. It includes tax calculations, customizable fields, and the ability to download and print pay stubs.

4. WageQuick

WageQuick is a solid choice for entrepreneurs who need to create real check stubs for their business. It supports various payment structures, including hourly, salary, and commissions. The free version allows you to generate a limited number of pay stubs.

5. StubCreator

StubCreator is an easy-to-use tool that allows you to create pay stubs for free with no hidden fees. It offers automatic tax calculations, customizable options, and secure downloads.

Conclusion

Choosing the right free paystub generator is crucial for ensuring your employees get accurate, professional pay stubs without breaking your budget. Look for a tool that offers customization, tax calculations, security, and ease of use. Free paystub generators are a great option for startups and entrepreneurs who need to keep payroll costs low while maintaining accuracy and professionalism.

By selecting the right tool, you’ll be able to generate real check stubs quickly and efficiently, helping you focus on growing your business while ensuring compliance and transparency with your employees.

Related Articles

How to Access Your MyHTSpace Pay Stub?

How to Get a Check Stub From TruBridge?

How To Get Paystub From Zachary

Everything You Need to Know About Your Ford Paycheck Stubs

How to Obtain Hobby Lobby Pay Stubs: A Detailed Guide

The Importance of Tracking Your Family Dollar Paystub for Tax Season

Leave a Reply