Every business, big or small, must maintain accurate payroll records to ensure smooth financial operations. One essential document that plays a crucial role in payroll management is the check stub. Whether you are an employer managing a team or a freelancer handling your finances, understanding the importance of check stubs can help keep your financial records organized and transparent. Using a check stub maker simplifies payroll processing, ensuring accuracy and efficiency.

What is a Check Stub?

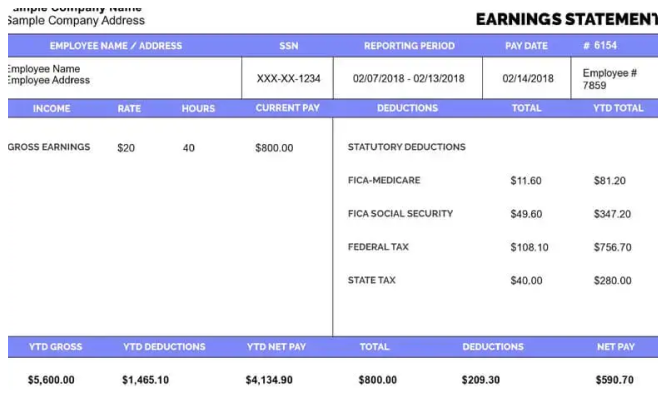

A check stub, also known as a pay stub, is a document that provides a detailed breakdown of an employee’s earnings, deductions, and net pay. It includes information about the gross wages earned, taxes deducted, benefits, and final take-home pay. Businesses and self-employed individuals use check stubs to maintain financial transparency and comply with legal requirements.

Why Are Check Stubs Important for Businesses?

1. Payroll Accuracy

A check stub maker helps businesses ensure payroll accuracy by automatically calculating earnings and deductions. This reduces the chances of errors that could lead to payroll disputes and dissatisfaction among employees.

2. Legal Compliance

Employers in the United States must comply with state and federal labor laws. Providing employees with detailed check stubs ensures compliance with these regulations. A check stub maker helps businesses generate accurate pay stubs that meet legal requirements, reducing the risk of fines or penalties.

3. Financial Transparency

Check stubs provide employees with a clear understanding of their earnings and deductions. Transparency in payroll builds trust within the organization and helps employees manage their personal finances more effectively.

4. Proof of Income

Employees often need check stubs as proof of income for various reasons, such as applying for loans, renting an apartment, or verifying employment history. Businesses that help accurate and well-documented check stubs their employees meet these financial requirements effortlessly.

5. Tax Documentation

Come tax season, both employers and employees need proper payroll records to file taxes accurately. A check stub maker simplifies record-keeping by ensuring all payroll details are well-documented and accessible when needed.

6. Simplifies Bookkeeping

For small businesses and freelancers, maintaining organized financial records is essential for efficient bookkeeping. Using a check stub maker allows businesses to generate, store, and retrieve payroll records quickly, reducing administrative workload.

Who Needs a Check Stub Maker?

Small Business Owners

Running a small business involves many responsibilities, including payroll management. A check stub maker simplifies the payroll process, ensuring employees are paid accurately and on time while maintaining proper records.

Freelancers and Self-Employed Individuals

Freelancers and self-employed professionals often struggle with maintaining financial records. Using a check stub maker helps them create professional pay stubs that serve as proof of income for tax filing and financial transactions.

HR and Payroll Departments

Larger businesses with dedicated payroll departments benefit from check stub makers as they streamline payroll processing, reduce errors, and improve efficiency in managing employee salaries and deductions.

Benefits of Using a Check Stub Maker

1. Saves Time and Effort

Manually creating check stubs can be time-consuming. A check stub maker automates the process, reducing the time spent on payroll calculations and document generation.

2. Reduces Payroll Errors

Mistakes in payroll calculations can lead to disputes and dissatisfaction. A check stub maker minimizes errors by automatically computing wages, deductions, and taxes.

3. Enhances Professionalism

Using a check stub maker helps businesses create professional-looking pay stubs, improving their credibility with employees, financial institutions, and tax authorities.

4. Cost-Effective Solution

Hiring an accountant or using expensive payroll software can be costly for small businesses. A check stub maker offers an affordable alternative, making payroll management accessible to all businesses.

5. Secure and Accessible Records

Digital check stub makers allow businesses to store payroll records securely and access them anytime. This reduces paperwork and ensures financial documents are well-organized.

How to Use a Check Stub Maker

Using a check stub maker is simple and efficient. Here’s a step-by-step guide:

-

Choose a Reliable Check Stub Maker – Look for an easy-to-use and trusted online check stub maker that suits your business needs.

-

Enter Employee Details – Input the necessary information, including employee name, pay period, hourly rate or salary, and hours worked.

-

Include Deductions and Taxes – Add details about deductions such as federal and state taxes, social security, Medicare, and other withholdings.

-

Generate the Pay Stub – The check stub maker will calculate earnings, deductions, and net pay automatically.

-

Download and Share – Once generated, you can download, print, or email the check stub to your employees or keep it for record-keeping.

Conclusion

Understanding the importance of check stubs for your business is essential for maintaining payroll accuracy, financial transparency, and legal compliance. Whether you run a small business, work as a freelancer, or manage a payroll department, using a check stub maker simplifies payroll management while reducing errors and saving time. Investing in a reliable check stub maker helps businesses operate more efficiently and ensures employees receive accurate and well-documented pay information. Start using a check stub maker today to streamline your payroll process and enhance financial organization!

Related Articles

How to Access Your MyHTSpace Pay Stub?

How to Get a Check Stub From TruBridge?

Everything You Need to Know About Your Ford Paycheck Stubs

How to Obtain Hobby Lobby Pay Stubs: A Detailed Guide

The Importance of Tracking Your Family Dollar Paystub for Tax Season

What is an eStub and How Does It Simplify Payroll Management?

How Does Verizon Paystub Help Ensure Payroll Accuracy and Transparency?

Understanding Your Pasadena Unified Paystub: A Quick Breakdown

Leave a Reply