Managing payroll can be one of the most challenging aspects of running a business, especially when it comes to generating accurate pay stubs. A pay stub is a vital document for both employers and employees. It provides a detailed breakdown of an employee’s earnings, deductions, and other important payroll information. Inaccurate pay stubs can lead to misunderstandings, tax issues, and even legal problems.

Fortunately, with the help of a free paycheck creator, generating accurate pay stubs becomes much easier. In this blog, we’ll explore how to generate correct and reliable pay stubs using a free paycheck creator and why this tool is a game-changer for businesses of all sizes.

Why Pay Stubs Are Important

Before we dive into how to generate pay stubs using a paycheck creator, it’s important to understand why these documents are so essential for businesses and employees alike.

For employees, pay stubs are crucial for several reasons:

- Record of earnings: Pay stubs provide a detailed record of an employee’s gross pay, taxes, deductions, and net pay.

- Proof of income: When employees need to prove their income for loans, mortgages, or other financial matters, pay stubs serve as an official record.

- Tax reporting: Employees use pay stubs to track their tax withholdings, making it easier for them to file their taxes accurately.

- Transparency: A clear pay stub helps employees understand how their pay is calculated, which builds trust with employers.

For employers, pay stubs are necessary for:

- Compliance with labor laws: Many states require employers to provide pay stubs to their employees, making this a legal requirement in certain regions.

- Tax documentation: Pay stubs are used for calculating payroll taxes and filing taxes correctly. They ensure that tax withholdings are accurate, helping businesses avoid penalties.

- Payroll management: Generating accurate pay stubs helps employers keep track of employee earnings and deductions, making payroll management more streamlined.

Now that we know the importance of pay stubs, let’s talk about how to generate them accurately using a free paycheck creator.

How a Free Paycheck Creator Helps You Generate Accurate Pay Stubs

A free paycheck creator is an online tool that helps businesses create and manage pay stubs without the need for expensive payroll software. These tools offer a range of features to ensure that your pay stubs are accurate, clear, and compliant with tax regulations. Here’s how you can use a paycheck creator to generate pay stubs with ease:

1. Input Employee Information

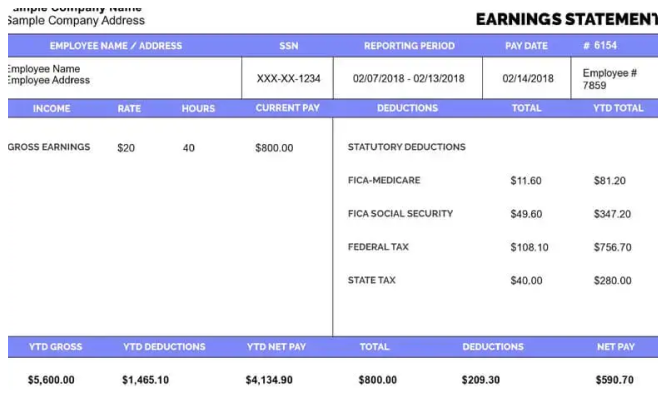

The first step in generating a pay stub is to enter the employee’s information into the paycheck creator. This typically includes:

- Employee name: Full name of the employee receiving the pay stub.

- Employee address: The employee’s mailing address (some states require this on pay stubs).

- Pay period: The time frame for which the employee is being paid (e.g., weekly, bi-weekly, or monthly).

- Pay date: The actual date on which the paycheck is issued.

The paycheck creator will allow you to input this basic information quickly and easily.

2. Enter Pay Information

Next, you’ll need to input the pay information, which includes:

- Hourly wage or salary: Whether the employee is paid by the hour or on a salary basis.

- Hours worked: For hourly employees, you’ll need to enter the total number of hours worked during the pay period.

- Overtime: If the employee worked overtime, the paycheck creator will allow you to enter those hours, ensuring that overtime pay (usually at 1.5x the normal rate) is calculated correctly.

- Bonuses or commissions: If the employee receives a bonus or commission, you can add this to their total earnings.

The free paycheck creator will then calculate the employee’s gross earnings automatically, based on the pay rate and hours worked.

3. Add Deductions

Next, you’ll need to enter any deductions that apply to the employee’s pay. Common deductions include:

- Federal income tax: This is typically calculated using the IRS tax tables based on the employee’s W-4 form.

- State and local taxes: In addition to federal taxes, you may need to account for state and local tax withholdings.

- Social Security and Medicare: These are standard deductions calculated at specific rates.

- Retirement contributions: If the employee is contributing to a 401(k) or other retirement plan, these contributions should be listed.

- Health insurance premiums: If the employee is enrolled in a health insurance plan, their share of the premium may be deducted.

A paycheck creator will typically have built-in tax calculation features, which ensure that the deductions are calculated correctly based on the current tax rates. Some tools also allow you to set up recurring deductions, making it easy to apply the same deductions for each pay period.

4. Calculate Net Pay

Once all the deductions are entered, the free paycheck creator will automatically calculate the net pay. This is the amount the employee will receive after all deductions have been taken out. The tool will subtract taxes, insurance premiums, and other deductions from the gross pay, leaving you with the final paycheck amount.

5. Review and Customize the Pay Stub

Before generating the pay stub, it’s a good idea to review the information entered to ensure everything is accurate. Most paycheck creators will offer a preview feature, allowing you to double-check the details before finalizing the document.

You may also want to customize the pay stub’s layout and design. Some paycheck creators offer customization options, allowing you to add your company’s logo, adjust the format, and select the information you want to display. While customization is optional, it can give your pay stubs a more professional appearance.

6. Generate and Distribute the Pay Stub

Once everything looks good, you can generate the pay stub. A paycheck creator will typically give you the option to download the pay stub as a PDF or print it directly. You can then distribute the pay stub to your employee either by printing it out and handing it to them or by emailing the PDF.

Some paycheck creators also offer the option to email the pay stub directly to the employee’s inbox, which can save you time and effort.

Why Using a Free Paycheck Creator is a Smart Choice

Generating accurate pay stubs is crucial for both employers and employees, and a free paycheck creator offers a simple, cost-effective solution for achieving this goal. Here are several reasons why using a free paycheck creator is beneficial for your business:

1. Cost Savings

Payroll software can be expensive, especially for small businesses or startups. Using a free paycheck creator allows you to create accurate pay stubs without incurring additional costs. For business owners on a budget, this is an affordable way to manage payroll.

2. Time Efficiency

A paycheck creator streamlines the process of generating pay stubs. Instead of manually calculating taxes and deductions, the tool automatically does the math for you, saving valuable time. This means you can focus more on growing your business and less on administrative tasks.

3. Accuracy

Manual payroll calculations are prone to mistakes. Even a small error in tax deductions or overtime calculations can lead to big problems down the road. A paycheck creator ensures that all calculations are done accurately, helping you avoid errors and potential legal issues.

4. Compliance

Tax laws and payroll regulations are constantly changing, and staying compliant can be challenging. Many paycheck creators are regularly updated to reflect the latest tax rates and legal requirements. This ensures that your pay stubs are in compliance with local, state, and federal regulations.

5. Employee Satisfaction

Accurate and timely pay stubs build trust between you and your employees. When employees see that their pay stubs are clear, accurate, and easy to understand, they’ll feel more confident in your company’s payroll practices. Happy employees are more likely to stay motivated and committed to their work.

Conclusion

Generating accurate pay stubs is a critical task for any business. Whether you have one employee or hundreds, using a free paycheck creator is a smart way to ensure your pay stubs are accurate, compliant, and professional. By automating the payroll process, you can save time, reduce errors, and ensure that your employees are paid correctly and on time.

A paycheck creator can help you avoid common payroll mistakes and provide your employees with the transparency they need to feel confident in their pay. With its cost-effective and efficient features, a free paycheck creator is an essential tool for any business looking to streamline payroll and improve accuracy.

Related Articles

How to Access Kroger Paystubs Anytime, Anywhere

Complete Guide to Dollar General Paystubs(DG Paystub) and DGME Portal

How to Use the Walmart Paystub Portal Easily?

Employee Guide: Accessing ADP Pay Stubs with Ease

How To Get a Pay Stub From Ford?

How to Access, Download, and Interpret Dollar Tree Pay Stubs

Why is Intuit Paystub Perfect for Payroll Management? 5 Key Reasons

Why Keeping Your Starbucks Pay Stub Is Important

Why Instacart Pay Stubs Matter for Your Financial Records?

Leave a Reply