When running a startup, every decision you make impacts the growth and success of your business. From developing your product to attracting customers, each step requires careful attention and effort. As your startup grows, one of the most important aspects that often becomes more complex is payroll. Managing your employees’ pay accurately, on time, and with proper documentation is crucial to keeping your team happy and your business compliant with regulations. This is where a paystub creator can play a pivotal role.

In this blog, we’ll explore how using a paystub creator can help scale your startup, ensuring smooth and efficient payroll management. Whether you have a handful of employees or are gearing up to hire more, a paystub creator can simplify payroll processes, reduce errors, and save valuable time as your business grows.

What is a Paystub Creator?

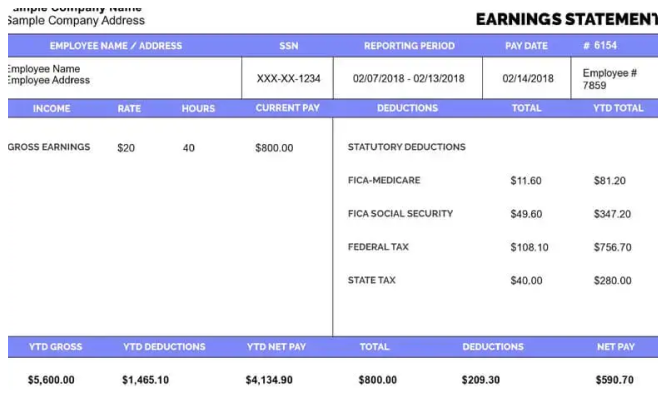

A paystub creator is a digital tool or software that generates pay stubs for your employees. A pay stub is a detailed document that outlines the breakdown of an employee’s earnings, taxes, deductions, and the net pay they receive. Pay stubs are an essential part of payroll as they provide transparency and clarity about how an employee’s compensation is calculated.

A paystub creator automates the process of generating these pay stubs. Instead of manually calculating deductions and taxes, you can input basic information (such as employee hours worked, pay rate, and deductions) into the tool, and the software will automatically generate an accurate pay stub for each employee. This tool can help you save time and ensure accuracy, especially as your business expands.

Why Your Startup Needs a Paystub Creator

As a startup, you’re likely handling many tasks in-house to keep costs low. Payroll is one area where precision is key, and even small errors can have significant consequences. A paystub creator is an investment that can simplify your payroll process, improve employee satisfaction, and ensure your business stays compliant with tax regulations. Let’s dive deeper into the reasons why your startup should invest in a paystub creator.

1. Accuracy and Compliance

When you are scaling a startup, managing multiple employees means keeping track of different pay rates, hours worked, bonuses, benefits, and taxes. Mistakes in these calculations can lead to overpaid or underpaid employees, which can cause dissatisfaction and even legal issues. A paystub creator helps reduce the risk of errors by automating the complex calculations for taxes, deductions, and benefits.

This accuracy ensures that your business stays compliant with tax laws, avoiding potential fines and penalties for mistakes in tax withholding or employee deductions. With frequent changes to tax rates, a paystub creator can be updated automatically to reflect the latest tax laws, saving you time and stress.

2. Saves Time and Increases Efficiency

As a startup founder, your time is precious. Between overseeing operations, marketing, customer service, and everything in between, you don’t want to spend hours manually preparing payroll. A paystub creator automates the entire process, saving you valuable time.

Rather than manually calculating deductions, tax withholdings, and net pay, you can simply input data such as hours worked, salary, or commission. The software does the rest, generating accurate pay stubs in a matter of minutes. As your startup scales and you hire more employees, a paystub creator will help streamline payroll processing, allowing you to focus on other aspects of your business.

3. Improves Employee Trust and Satisfaction

Employees rely on their pay stubs to understand how their pay is calculated. Clear and transparent pay stubs that show all deductions, taxes, and benefits create trust between you and your employees. When employees receive accurate, easy-to-understand pay stubs, it fosters a sense of transparency and fairness within your company.

For startups, where resources may be limited and employees are wearing multiple hats, providing professional pay stubs using a paystub creator is an effective way to show employees that you value their work and care about their compensation. This can also help you retain top talent, as employees will appreciate the professionalism and clarity of their pay information.

4. Customizable and Flexible for Your Startup’s Needs

As your startup grows, your payroll needs will evolve. A Free paystub creator offers flexibility and customization options that allow you to tailor pay stubs to fit your specific business requirements. You can easily add or remove sections for bonuses, commissions, benefits, taxes, and other deductions, depending on how your business operates.

For example, if you offer unique benefits to employees, such as performance bonuses, healthcare deductions, or stock options, a paystub creator can accommodate these customizations. This flexibility is especially valuable for startups that might experiment with different compensation structures or offer various incentive programs.

5. Boosts Professionalism

As a startup, presenting a professional image is essential, especially when interacting with employees, clients, and investors. A paystub creator allows you to generate clean, professional-looking pay stubs that reflect your company’s attention to detail. Well-designed pay stubs that include important details like employee name, pay period, earnings, deductions, and net pay show that you’re running a legitimate, organized business.

Professional pay stubs also enhance the experience for your employees. When they receive clear, easy-to-read pay stubs, it conveys that your company is organized and committed to providing quality support. This can go a long way in building employee loyalty and trust, which are crucial for the success of any startup.

6. Paperless and Eco-Friendly

In today’s world, going paperless isn’t just more efficient – it’s also more environmentally friendly. A paystub creator allows you to generate digital pay stubs, which can be emailed to employees or stored in a secure online system. This eliminates the need to print physical copies, reducing your business’s paper usage and lowering costs associated with printing and mailing.

Going digital also means that pay stubs are easier to organize and access. Employees can log in to a secure portal to access their pay stubs at any time, reducing the need for time-consuming manual record keeping. You can also easily retrieve past pay stubs during tax season or in case of audits, making the process more convenient and efficient.

7. Secure and Confidential

Employee pay information is sensitive data that needs to be handled with care. A paystub creator ensures that employee pay details are kept secure. Many paystub creators use encryption technology to protect sensitive data and ensure that it is only accessible to the employee and authorized personnel.

Unlike paper pay stubs, which can be lost, stolen, or misplaced, digital pay stubs are stored securely in the cloud or on private servers. This reduces the risk of data breaches and ensures that your employees’ personal and financial information remains confidential.

8. Cost-Effective Solution

Startups often have tight budgets, and hiring a payroll department or outsourcing payroll management can be expensive. A paystub creator provides a cost-effective solution for startups by eliminating the need for external payroll services or in-house payroll teams. The software can handle all payroll tasks, from creating pay stubs to calculating deductions and taxes, at a fraction of the cost of outsourcing.

Additionally, many paystub creators offer subscription-based pricing with affordable plans tailored to businesses of all sizes. Whether you have a handful of employees or plan to scale rapidly, a paystub creator offers a budget-friendly solution for managing payroll effectively.

9. Helps with Tax Filing and Documentation

Tax season can be a stressful time for any business, but it can be particularly challenging for startups. A paystub creator can help by generating accurate pay stubs that reflect the necessary tax withholdings and deductions. These pay stubs can be used as documentation for tax filings, making it easier to complete your business’s taxes.

With a paystub creator, your payroll records will be organized, accurate, and readily available when it’s time to file taxes. This reduces the chances of errors and ensures that you’re compliant with IRS regulations.

Choosing the Right Paystub Creator for Your Startup

Not all paystub creators are the same, so it’s important to choose one that fits your startup’s unique needs. Here are a few key features to look for:

- User-Friendliness: Choose a tool that’s easy to navigate, especially if you’re not a payroll expert. The software should have a simple interface for inputting employee data and generating pay stubs.

- Customization: The paystub creator should allow you to customize pay stubs to include the necessary deductions, bonuses, and benefits for your employees.

- Compliance: Make sure the software stays up-to-date with tax laws and can handle tax calculations for both federal and state requirements.

- Security: Ensure that the paystub creator offers secure storage options and protects sensitive employee data.

- Customer Support: Look for a provider that offers reliable customer support, especially if you run into issues with the software or need help with payroll.

Conclusion

Scaling your startup comes with its challenges, but payroll doesn’t have to be one of them. By investing in a paystub creator, you can simplify the payroll process, ensure accuracy, save time, and improve employee satisfaction. This tool not only helps you maintain compliance but also contributes to the professionalism and efficiency of your business as it grows.

As your startup expands, managing payroll manually becomes increasingly difficult and time-consuming. A paystub creator is an essential tool for keeping your payroll process smooth, secure, and cost-effective. With this tool, you can focus on what matters most: growing your business and achieving your goals.

Related Articles

How to Access Your MyHTSpace Pay Stub?

How to Get a Check Stub From TruBridge?

Everything You Need to Know About Your Ford Paycheck Stubs

How to Obtain Hobby Lobby Pay Stubs: A Detailed Guide

The Importance of Tracking Your Family Dollar Paystub for Tax Season

What is an eStub and How Does It Simplify Payroll Management?

How Does Verizon Paystub Help Ensure Payroll Accuracy and Transparency?

Understanding Your Pasadena Unified Paystub: A Quick Breakdown

Leave a Reply